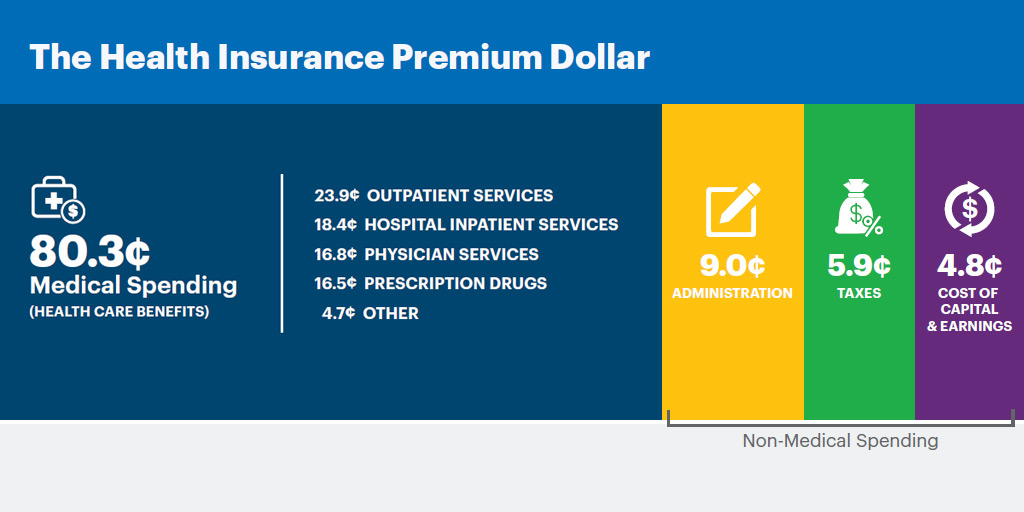

Prescription drugs, outpatient services, and taxes on health insurance are key drivers of premium increases, according to a recently released UnitedHealth Group brief. The brief finds that the main medical drivers of the 5.5% average premium increase between 2013 and 2018 are:

- Outpatient Services: 8% annual growth, driven by the rising cost of care in emergency departments and surgeries.

- Prescription Drugs: 7% annual growth, driven by the rising cost of specialty drugs.

In addition, high and increasing taxes, including the ACA Health Insurance Tax, are driving up the cost of premiums. The brief found:

- 5.9 cents of each premium dollar goes to pay for federal, state, and local taxes on health insurance.

- In 2018, an annual family premium of $18,000 included over $1,000 in taxes.

- For a business covering 1,000 employees and their families, $18 million in 2018 health insurance premiums included over $1 million in taxes.

- Taxes on health insurance increased nearly 20% from 2017 to 2018 due to the reinstatement of the ACA Health Insurance Tax.

Share This Story